Mining Taxation: Reporting and Managing Income from Cryptocurrency Mining

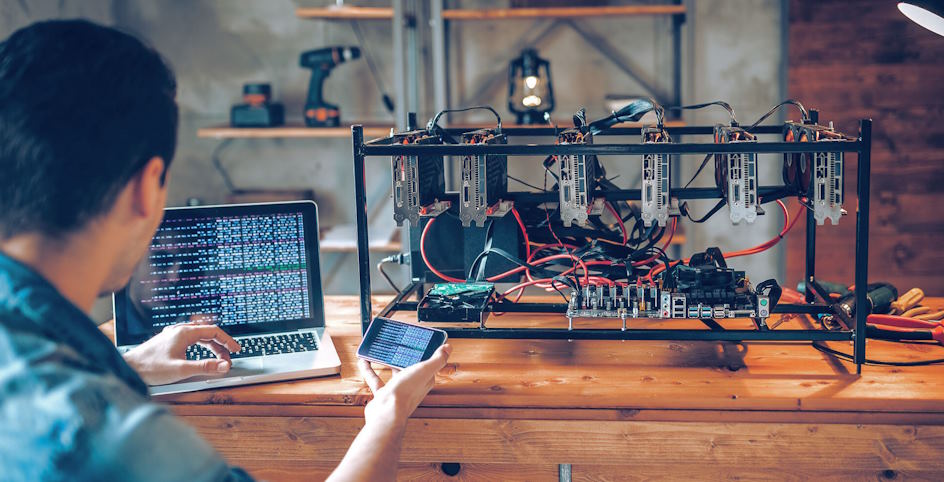

As the digital age gains momentum, cryptocurrencies have emerged as a disruptive force in the world of finance and technology. At the core of this paradigm shift lies the process of cryptocurrency mining, where individuals and entities deploy computational power to validate transactions and maintain the integrity of blockchain networks. While mining serves as the backbone of these decentralized ecosystems, it also presents a conundrum when it comes to taxation. The revolutionary nature of cryptocurrencies has outpaced traditional tax frameworks, necessitating a comprehensive understanding of how mining income should be reported and managed.

Taxation Regulations for Cryptocurrency Mining

The taxation of mined cryptocurrencies varies based on their classification as property, income, or a combination of both. Additionally, the frequency and scale of mining operations (hobbyist vs. professional) influence the tax implications. Hobbyist miners may be subject to different rules than professional miners operating as businesses. Adhering to proper reporting requirements is essential to ensure compliance with tax laws.

Determining Taxable Income from Mining

Calculating taxable income from mining involves accounting for several factors, including the fair market value or cost basis of the mined cryptocurrency. Block rewards, transaction fees, and the volatility of cryptocurrency prices add complexity to this calculation. Miners must find effective ways to address price fluctuations to accurately report their income.

Keeping Accurate Records

Detailed record-keeping is indispensable in the world of cryptocurrency taxation. Tracking essential information such as the date of mining, type of mined coin, utilized mining pool, and the value of the cryptocurrency at the time of mining helps establish a clear audit trail. Specialized cryptocurrency accounting tools can streamline this process, facilitating comprehensive and accurate record-keeping.

Reporting Mining Income on Tax Returns

Navigating the labyrinth of tax forms for reporting mining income is a crucial step in compliance. Hobbyist miners often report their mining income on Schedule C, while professional miners might use Form 8949. Understanding which forms to use and how to accurately report income ensures adherence to tax regulations.

Deductible Expenses and Tax Credits

Cryptocurrency miners may be eligible for deductions on expenses incurred during the mining process, such as energy costs, equipment depreciation, and maintenance expenses. Moreover, eco-friendly mining practices might qualify for tax credits, promoting environmentally conscious approaches to mining operations.

Navigating International Taxation

For miners engaged in cross-border operations, navigating international taxation becomes a priority. Double taxation agreements and reporting requirements for foreign mining income must be carefully considered to avoid legal complications and optimize tax obligations.

Compliance and Risk Management

Compliance with cryptocurrency tax regulations is paramount to avoid potential penalties and legal repercussions. Failing to adhere to tax laws can lead to hefty fines or legal action. Seeking professional guidance can mitigate risks and ensure miners remain on the right side of the law.

Future Trends in Mining Taxation

The landscape of cryptocurrency regulations is in constant flux, demanding miners to stay updated on evolving tax policies. Anticipating changes in taxation frameworks and adapting to new reporting requirements will be essential for long-term success in the mining industry.